How Trump's wild tariff ride has changed mortgages By Andrew Martinez April 9, 2025 6:46…

Mortgage interest rates forecast: Will rates go down in June 2021?

Mortgage interest rates forecast: Will rates go down in June 2021?

Mortgage rates forecast for June 2021

Mortgage rates could stay close to 3% in June, as they’ve done this spring.

But when it comes to overall trends, we’re far more likely to see a steady increase in rates than any substantial drop.

Some agencies predict rates as high as 3.5% or 3.6% by the end of summer. Others think we’ll see a more modest increase to around 3.3% in the same time frame.

Though exact forecasts vary, the consensus is for higher rates in the near future.

Locking a rate soon could secure you a great deal, while waiting on further drops is risky.

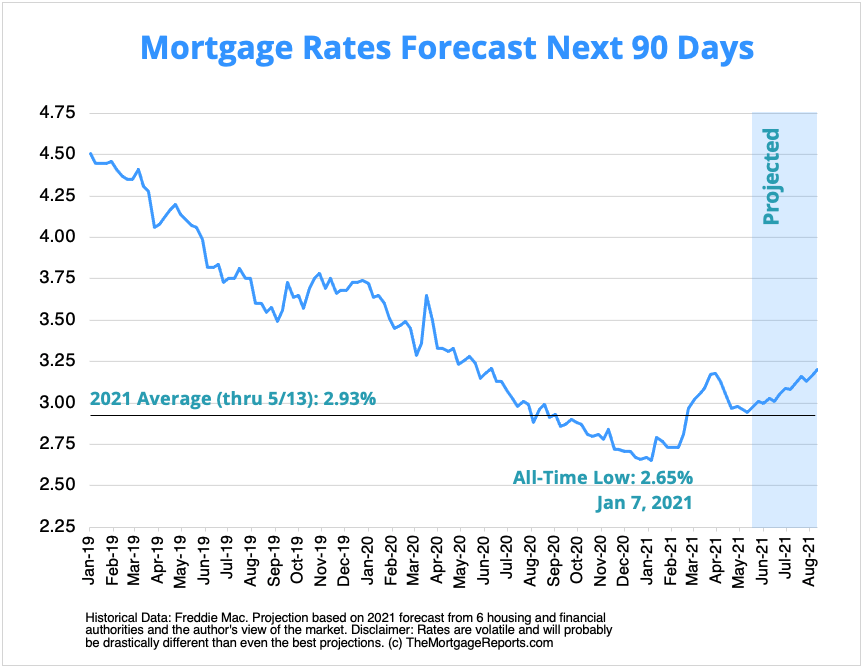

Mortgage rates forecast next 90 days

Mortgage rates are closely tied to the health of the U.S. economy. And the country as whole is on an upswing, which should lead to higher rates in June and the coming months.

However, recovery has been a bit uneven.

Some indicators, like the inflation rate, are soaring. Others, like the current employment situation, are off to a rockier start than expected.

Mortgage rates could continue to fluctuate as a result.

But while some weeks might bring dips and others spikes, expect to see an overall upward trend as 2021 progresses.

Predictions for June 2021

We’ve been predicting higher rates for a while now. And though rates did spike briefly in April, they took a surprise tumble — falling below 3% in May, according to Freddie Mac.

Since then, rates have wavered in the high-2% to low-3% range, depending on which lenders (and borrowers) you look at.

But we still believe mortgage rates are set to rise in June and the following months.

The simple reason is that the forces likely to drive rates higher are much stronger — at least at the moment — than those that could push rates lower.

Holding out for higher rates

Mortgage rate forecasting is an exercise in probability. If you’re trying to determine the right time to lock a rate, you have to ask yourself: what could drive rates higher or lower? And which scenario is most likely?

Currently, there are two strong arguments in favor of higher rates and one against.

In the camp of higher mortgage rates, we’re looking at:

- Rising inflation rates in the U.S. — The big worry on investors’ minds at the moment is inflation. April inflation numbers (reported in May) showed a stunningly high increase in consumer prices. And when inflation goes up, so do rates, because investors purchasing mortgage-backed securities need to see bigger returns in order to profit. Learn more about how inflation affects interest rates here

- An improving U.S. economy — Economic growth almost always leads to higher rates, and most economists and investors believe a boom is imminent. Surprisingly low employment numbers for April had some hedging their bets about the pace of recovery. But with over a third of the nation’s adults fully vaccinated, wide-spread recovery seems more a question of “when” than “if”

What could push mortgage rates down? The most probable cause would be a resurgence in coronavirus cases.

An outbreak of a new, more vaccine-resistant COVID strain in the U.S. could put a major damper on the current economic outlook.

Even a renewed wave of the virus outside the U.S. could have a sizable impact.

Further shutdowns among U.S. trading partners and major world economies could urge investors to keep their dollars in relatively safe U.S. investments — like 30-year mortgage bonds. And when there’s an influx of cash into mortgage-backed securities (MBS), borrowers’ rates go down.

These scenarios are far from impossible. The course of the pandemic has been, and continues to be, unpredictable.

But how likely is it rates will go down instead of up? Not very, according to most experts.

We should still see higher mortgage rates in the summer and beyond. Though if borrowers are lucky, the rise could happen more slowly than initially expected.

Time your mortgage, not your rate

Mortgage rates are moving unpredictably at the moment. They’re not reacting to economic reports like ‘normal,’ making it difficult for even the most seasoned experts to predict future rates accurately.

With that in mind, does it make sense to try to time your rate lock for the next small drop?

We’d recommend focusing on your own needs rather than market movements.

Are you ready and qualified to refinance or buy a home? Then today’s rates are likely as good as tomorrow’s or next month’s.

In fact, you might save as much by simply shopping for your lowest rate as you would by timing your lock for a day when average rates are down.

Consider that Freddie Mac’s highest 30-year rate since March was 3.18%. The lowest was 2.94%. That’s a difference of just 24 basis points (0.24%).

On the day this was written, we saw advertised 30-year fixed rates1 ranging from just 2.50% to 3.125% — a difference of 62.5 basis points.

That means you could potentially save as much or more by shopping around as you could by having ‘perfect’ timing.

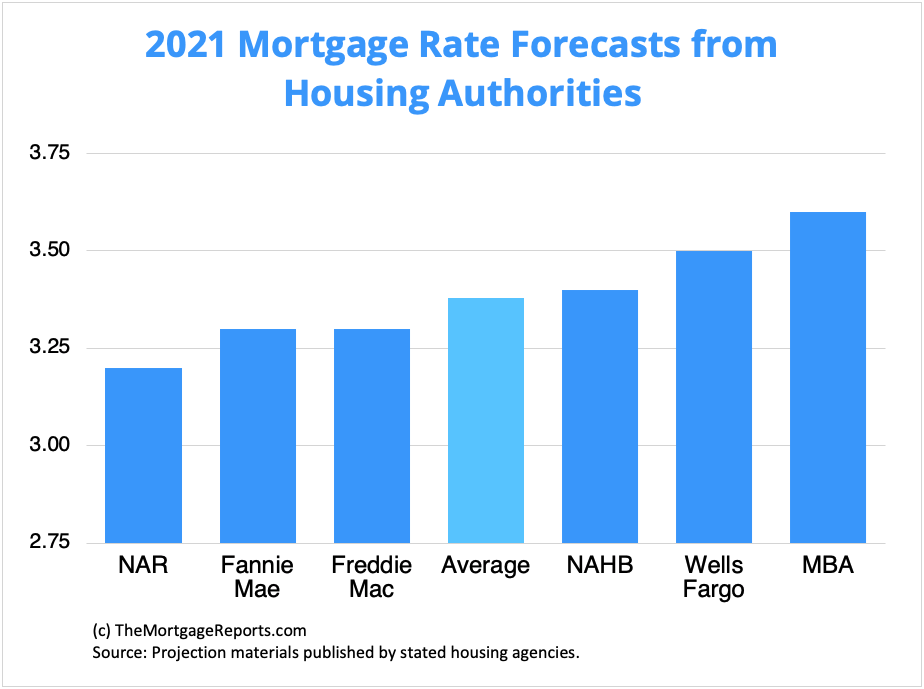

Mortgage rate trends as predicted by housing authorities

Housing agencies nationwide are calling for rates in the low- to mid-3s in the second half of 2021.

The Mortgage Bankers Association and Wells Fargo believe 30-year rates could go as high as 3.5% or 3.6% by the end of summer, while Fannie Mae and Freddie Mac predict mortgage rates around 3.3% in the next few months.

Either scenario would be an increase from today’s mortgage rates, which are currently averaging close to 3%, according to Freddie Mac’s weekly survey:

| Agency | 30-Yr Rate Prediction |

| National Assoc. of Realtors | 3.20% |

| Fannie Mae | 3.30% |

| Freddie Mac | 3.30% |

| National Assoc. of Home Builders | 3.40% |

| Wells Fargo | 3.50% |

| Mortgage Bankers Assoc. | 3.60% |

| Average of all agencies | 3.38% |

To sum it up, rate predictions vary widely.

Mortgage rates could stay near historic lows throughout the year. Or they could spike up to pre-2020 levels.

The Fed to keep its benchmark rate low until 2023

The Federal Reserve has a few levers with which to keep rates low in the economy.

Mortgage rates are most heavily affected by the Fed’s bond purchasing program. Throughout the pandemic, the Federal Reserve has been buying $40 billion worth of Mortgage Backed Securities (MBS) per month.

MBS prices drive mortgage rates, and the Fed’s injection of cash into this market pushed rates to their lowest lows in 2020.

Another, indirect method of rate suppression is for the Fed to keep its benchmark rate — the federal funds rate — near zero.

This rate level allows banks to borrow money at nearly no cost, which has a trickle-down effect on consumer borrowing and interest rates in general.

The Fed’s current rate-friendly stance is a boon for mortgage shoppers.

What does this mean for the personal finances of the average American consumer?

It means you’ll likely have access to ultra-low rates for years. Perhaps not as low as they are now, but very low from a historical standpoint.

Mortgage strategies for June 2021

Rates seem likely to rise in June and beyond. But there are still great opportunities to be had for home buyers and refinancing homeowners in 2021.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the next few months.

New low-income refinance program starts in June

Thanks to near-record-low mortgage rates, many homeowners were able to save thousands by refinancing their mortgages in 2020 and early 2021.

But the benefits of refinancing haven’t been evenly distributed. Those with lower or credit or income simply haven’t had as many refi opportunities as ‘prime’ borrowers.

A new refinance program aims to change that.

Starting in June 2021, low-income homeowners with Fannie Mae-backed loans will have access to a new loan option called RefiNow.

The program will save eligible borrowers at least $50 per monthly payment, and could lower the upfront cost of refinancing by waiving home appraisals and the Adverse Market Refinance Fee.

A similar refinance loan from Freddie Mac, called Refi Possible, should be available starting in August.

If you’ve been considering a refinance but didn’t think you’d qualify, ask your lender about these programs.

Home buyers: Look out for new grants and stimulus programs

Rising home prices have become a real challenge for home buyers in many parts of the nation.

First-time home buyers, especially, might be short on the savings needed for increased down payment and closing cost requirements.

Fortunately, these challenges haven’t gone unnoticed.

Mortgage lenders, housing agencies, and even the federal government are taking steps to help with affordability issues in today’s market.

Home buyers should look into down payment assistance programs in their area.

Even before the pandemic, there were over 2,000 of these first-time home buyer programs operating across the nation.

New assistance programs have even sprung up during the pandemic, in a bid to help buyers navigate tighter financial constraints. These may offer grants or low-interest, forgivable loans to help with the down payment and closing costs on a home purchase.

Looking toward the rest of 2021, new legislation could be on the horizon to help home buyers as well.

President Biden’s proposed $15,000 tax credit for first-time buyers is currently working its way through Congress. So is a bill for a $25,000 grant program to help first-generation homeowners.

Neither of these bills has passed yet. But those buying later in 2021 should keep an eye out for news on these programs. They could be a huge help in bridging the gap from renting to homeownership

Loan product rate updates

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are updates for specific loan types and their corresponding rates.

Conventional loan rates

Conventional refinance rates and those for home purchases are moving away from record-low territory, although they’re still at a low point historically.

According to loan software company ICE Mortgage Technology, the 30-year mortgage rate averaged 3.25% in April, up significantly from 3.02% in March.

Keep in mind, though, average rates account for all sorts of borrowers.

One of the advantages of a conventional home loan is that borrowers with higher credit and bigger down payments are rewarded with lower rates.

So even in a rising rate environment, ‘prime’ borrowers can often still find great deals.

Lower-credit-score borrowers can use conventional loans, too. But these loans are best suited for those with decent credit and at least 3% down.

Five percent down is preferable if you can afford it, due to higher rates that come with lower down payments.

And twenty percent equity is preferred when refinancing, as you won’t have to pay for private mortgage insurance (PMI) on the new loan.

If you have significantly more than 20% equity when you refi, you may be able to tap your home’s equity at a low rate via a conventional cash-out refinance.

FHA mortgage rates

FHA is currently the go-to program for home buyers who may not qualify for conventional loans.

The good news is that current FHA mortgage rates are often similar to — or even lower than — interest rates on conventional loans.

According to ICE Mortgage Technology, FHA loan rates averaged 3.23% in April, a hair below the average conventional rate.

Another interesting stat from the report: The average FICO score for FHA home buyers is currently just 670, compared to 759 for conforming loan borrowers.

FHA loans come with mortgage insurance. But the overall cost is not much more than for conventional loans.

And there are perks for current homeowners with FHA loans, too.

A little-known program, called the FHA streamline refinance, lets you convert your current FHA loan into a new one with a lower rate and mortgage payment.

An FHA streamline mortgage application requires no W2s, pay stubs, or tax returns. And you don’t need an appraisal, so home value doesn’t matter.

VA mortgage rates

VA loans come with the lowest rates of all loan types according to ICE Mortgage Technology.

In April, 30-year VA mortgage rates averaged just 2.95% while conventional loans averaged 3.25%, representing a big discount if you’re a veteran or service member.

Homeowners with a current VA loan may be eligible for the ever-popular VA streamline refinance.

No income, asset, or appraisal documentation is required.

If you’ve experienced a loss of income or diminished savings, a VA streamline can get you into a lower rate and better financial situation. This is true even when you wouldn’t qualify for a standard refinance.

But don’t overlook the VA loan for home buying. It requires zero down payment.

That means if you have the cash for closing costs, or can get them paid for by the seller, you could potentially buy a home without saving any additional funds.

VA mortgages are offered by local and national lenders, not by the government directly. Most active-duty members or veterans of the United States military can qualify.

USDA mortgage rates

Thanks to their backing from the U.S. Department of Agriculture, USDA mortgage rates are ‘below-market.’ That means you’ll typically get a lower rate with USDA than conventional financing.

And there are other benefits, too.

Like FHA and VA, current USDA loan holders can refinance via a “streamlined” process.

With the USDA streamline refinance, you don’t need a new appraisal. You don’t even have to qualify using your current income. The lender will only make sure that you are still within USDA income limits.

Home buyers are also learning the benefits of the USDA loan program for home buying.

No down payment is required, and rates are ultra-low.

Home payments can be even lower than rent payments, as this USDA loan calculator shows.

Qualification is easier because the government wants to spur homeownership in rural areas. Home buyers might qualify even if they’ve been turned down for another loan type in the past.

Like FHA and VA loans, the USDA program is for people who want to buy or refinance a primary residence; these loan programs aren’t for real estate developers.

Mortgage rates today

While tracking monthly mortgage rate forecasts and weekly averages can be helpful, it’s important to know that rates change daily.

You might get 3.00% today, and 3.125% tomorrow. Many factors alter the direction of current mortgage rates.

June economic calendar

The next 30 days hold no shortage of market-moving news. In general, news that points to a strengthening economy could mean higher rates, while bad news from economists can make rates drop.

- Friday, June 4: Nonfarm Payrolls, wages, unemployment rate

- Thursday, June 10: Inflation Rate

- Tuesday, June 15: Retail Sales, NAHB Housing Market Index

- Wednesday, June 16: FOMC Meeting, Fed Interest Rate Decision

- Wednesday, June 16: Housing Starts, Building Permits

- Tuesday, June 22: Existing Home Sales

- Wednesday, June 23: New Home Sales

- Thursday, June 24: GDP Growth Rate

- Friday, June 25: Personal Income, Personal Spending

- Wednesday, June 30: Pending Home Sales

Note that current uncertainty in the U.S. economy — driven by the pandemic — means mortgage rates aren’t always reacting to economic news like normal.

So keep an eye on what’s going on in the market. But, more importantly, time your rate lock for when you are ready and qualified to buy a home or refinance.

Especially in today’s market, your personal readiness should take precedence over any ‘market movers’ when deciding to lock in a mortgage.